Interested in a Corporate TUD+ Membership?Speak to our team today for a special end-of-year discountSpeak to our team for an end-of-year discount

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

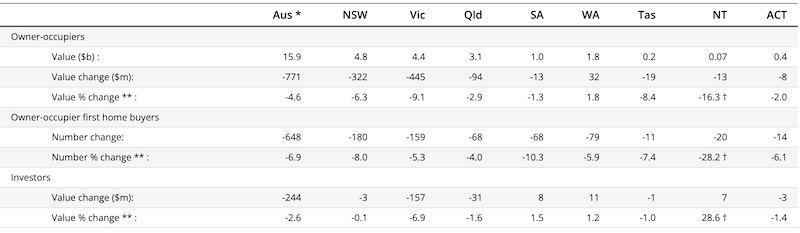

The number of new owner-occupier home loans fell 2.6 per cent in January, the second decline in a row.

But, says the Australian Bureau of Statistics (ABS), which released the data, the loans have grown in trend terms by 1.5 per cent over the year.

ABS head of finance statistics Dr Mish Tan said that liaison with lenders “suggests that recent improvements to loan processing times increased the number of loans processed in peak periods this year, relative to prior years”.

The number of refinanced owner-occupier home loans between lenders fell 7.6 per cent and was 30.8 per cent lower than a year ago.

“The volume of loans being refinanced was comparatively higher than new loans for the first half of 2023, but has since fallen sharply as lenders reduced competitive cashback offers,” Tan said.

The number of owner-occupier first-home-buyer loans fell 6.9 per cent in January 2024, but was 4.4 per cent higher compared to January 2023.

Housing finance loan commitments

By property purpose and state, seasonally adjusted, January 2024

Meanwhile, the value of these loans fell 6 per cent in the month, but was 13.2 per cent higher compared to a year ago.

In original terms, the average loan size for a first-home-buyer loan rose from $485,000 to $514,000 over the year.

The data showed more needed to be done to tackle supply constraints in the housing pipeline as new home building and lending declines, Master Builders Australia said

Chief executive Denita Wawn said resolving supply constraints should be the focus for all political parties in fixing the housing crisis, and until they were addressed, Australians would continue to struggle with housing affordability.